Export Commissionerate

- Helpline No. : 022-268226612

- Email: commr-cus4mum3[at]nic[dot]in, estt-techexportacc[at]gov[dot]in

Export Procedures

Export Procedures

Registration Process for Exporters

Exporters must obtain an Importer Exporter Code (IEC) from the Directorate General of Foreign Trade (DGFT) for filing a Shipping Bill. Exporters must also register their Authorised Foreign Exchange Dealer Code (AD Code) with Customs. Exporters intending to export under an Export Promotion Scheme must register their Licences/DEEC book with the Customs Authorities. Depending on the export policy, exporters may need specific licenses or permits from the Directorate General of Foreign Trade (DGFT) or other concerned authorities.

Processing of Shipping Bill

Shipping Bill is the primary document for customs clearance, detailing the goods, their value, and other relevant information. Under the EDI system, declarations must be filed through ICEGATE from the office of the Exporter or the Customs Broker. A checklist is generated for data verification by the exporter or their agent. After verification, the data is submitted to the system, which generates a Shipping Bill number. This number is endorsed on the printed checklist and returned to the exporter/agent. For exports subject to export cess, the TR-6 challan for cess is printed immediately after the Shipping Bill submission and must be paid at the designated bank.

Shipping bills are processed either automatically by the system based on the exporters' declarations or manually by Customs officers. If necessary, the officer may request for samples to verify declared values or classifications. Special instructions for examination may also be provided. After assessment (to determine the applicable duties and taxes) of the Shipping Bill an assessed copy of Shipping Bill is generated.

Exporters or their agents can check the status of the Shipping Bill at the Service Centre's query counter. The Shipping Bill is assessed once all queries are resolved.

Examination of Export Goods at Docks

Once the goods arrive at the port, the port authorities endorse the quantity of the goods received on the reverse of the checklist. Further, goods need to be brought to the designated area for registration & examination/inspection by the Customs authorities.

After registration of the Shipping Bill, the EDI System marks the Shipping Bill for inspection/examination. Customs officials will inspect/examine the goods to ensure they match the declared details based on the checklist and declarations submitted by the exporter and that all regulations are followed. If everything is as per declaration and as per policy/regulations, a "Let Export Order" is issued allowing the goods to be exported.

Whenever, there is a requirement of samples for analysis/testing of the goods, the Customs Officer draws samples and forward the same to the concerned testing lab.

Amendment in Shipping Bill

Any corrections in the checklist can be made at the Service Centre before the Shipping Bill number is generated. Once the Shipping Bill number is generated or when the goods have arrived at the Export Dock, amendments can only be made with the approval of the Assistant Commissioner (Export) or Additional/Joint Commissioner (Export). If changes are required after the issuance of the 'Let Export Order', the Shipping Bill must be amended and re-approved by the competent authorities.

Procedure for Post Clearance amendment in Shipping Bill: Exporter/CHA submits an amendment request along with supporting documents such as invoice, packing list, Bank Realization Certificate (BRC) etc.

The Manifest Clearance Department (MCD) Section verifies whether the request falls under permissible amendments as per Section 149 of the Customs Act, 1962. If documents are complete and amendments are valid, the file is forwarded to the Assistant/Deputy Commissioner for approval. Once approved, the manual certificate of amendment is issued to exporter as per the request of exporter. Amended details in the Shipping Bill are endorsed with an official remark to indicate post clearance modification.

Drawback

Duty Drawback is a scheme administered by CBIC to promote exports. It rebates the incidence of Customs and Central Excise duties, chargeable on imported and excisable material respectively when used as inputs for goods to be exported. This WTO compliant scheme ensures that exports are zero-rated and do not carry the burden of the specified taxes. The scheme comprises three categories, i.e.

- All Industry Rate (AIR) of Duty Drawback: The AIR of Duty Drawback for an export product is an average rate, based on the average quantity and value of material and average duties of Customs and Central Excise borne by each class of material, from which export goods are ordinarily manufactured.

- Brand Rate of Duty Drawback: Brand Rate of Duty Drawback is a unique facility provided to exporters for a rebate of actual duty incidence suffered by an export product. Under the Brand Rate mechanism, a specific Duty Drawback rate can be applied for by the exporter if the export product does not have an AIR or the available AIR neutralises less than 80 per cent of the duties paid on materials used in the manufacture of export goods.

Brand Rates are fixed by the local Commissioners of Customs having jurisdiction over the place of export of goods on which Brand rate of Duty Drawback is claimed

Pending the fixation of Brand Rate, the AIR of Duty Drawback, where available, can be availed upfront by the exporter.

Provisional Brand Rate can be allowed by the Commissioner of Customs on the exporter’s request.

Brand Rate of Duty Drawback is disbursed electronically directly to exporter’s account in a manner similar to the disbursal of AIR of Duty Drawback

- Duty Drawback on re-export of imported goods: Duty Drawback can also be claimed on the export of duty-paid imported goods. Under this facility, goods imported earlier may be exported and Duty Drawback of up to 98% of import duty paid can be claimed on such exports. Proof of duty paid on importation and identification of the export goods as those that were imported earlier are among the primary requirements under this scheme.

Procedures: Exporter files the Shipping Bill under Section 74 (Drawback allowable on Re-export of duty-paid goods) and brand rate Shipping Bill under section 75 (if drawback disbursed is low or not determined). The exporter files the application alongwith relevant documents to the Drawback Section to manually process the claim in both cases.

In the case of drawback application under Section 74, O-I-O is issued by the DC/AC, Drawback Section after following the due procedure and verifying the relevant documents. While in case of Brand Rate Shipping Bill, once the Brand rate fixed by the competent authority, the Shipping Bill processed in EDI System as a supplementary claim.

AEO Scheme (Authorised Economic Operator)

- AEO is a programme under the aegis of the World Customs Organization (WCO) SAFE Framework of Standards to secure and facilitate Global Trade. The programme aims to enhance international supply chain security and facilitate movement of legitimate goods.AEO encompasses various players in the International supply chain.

- Under this programme, an entity engaged in international trade is approved by Customs as compliant with supply chain security standards and granted AEO status & certain benefits.

- India’s AEO Programme is in sync with the commitments made under Article 7.7 of WTO TFA. AEO is a voluntary compliance programme. It enables Indian Customs to enhance and streamline cargo security through close cooperation with the principle stakeholders of the international supply chain viz. importers, exporters, logistics providers, custodians or terminal operators, custom brokers and warehouse operators.

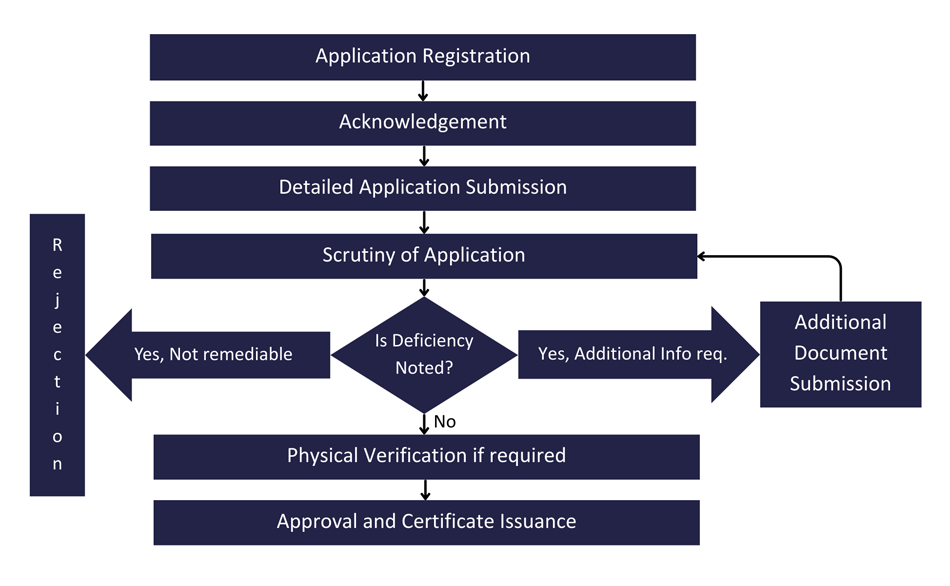

Application Process:

AEO Cell, Mumbai Zone – III Initiatives

- Annual AEO Mela

- “Wednesday is AEO Day” Initiative

- Webinar on AEO Certification and its Benefits

- AEO Interactive Session in India Russia Business Meet

- AEO Interactive Session in various business meets

OMS (Obligation Management System)

OMS is an online portal “Obligation Management System (OMS)” (https://oms.accmumbai.gov.in/) using Block Chain technology for registration/cancellation and monitoring of Advance Authorizations (AA).

All the Advance Authorizations are registered/cancelled in a faceless manner, where Trade uploads the document from his office on OMS and if any query(s) is raised by the department, that is also replied on OMS itself in online mode. Moreover, the Notices for submission of Export Obligation Discharge Certificate (EODC) are automatically and timely sent by the OMS, thereby improving the compliance of discharge of export obligation.

Export Promotion Schemes

- Advance Authorisation Scheme (AA) allows duty free import of inputs, which are physically incorporated in export product (making normal allowance for wastage). Fuel, oil, catalyst which is consumed / utilized in the process of production of export product, may also be allowed.

- Duty Exemption Entitlement Certificate (DEEC) scheme manages duty-free import of inputs under the Duty-Free Exemption Certificate (DEEC) Scheme for exporters.

- Duty Free Import Authorisation (DFIA) similar to the Advance Authorisation Scheme (AA), it allows duty free import of inputs but on Post Export basis only.

- Export Promotion Capital Goods (EPCG) scheme allows import of Capital Goods for producing quality goods and services to enhance India’s export. The EPCG Scheme allows Import of Capital Goods at Zero Customs Duty. Integrated Goods and Service Tax (IGST) and compensation Cess are also exempted under the scheme.

- Duty Drawback (DBK) allows rebate of duty on any goods manufactured in India and Exported. DBK excludes Integrated Goods and Service Tax (IGST) and Compensation. The Duty Drawback Scheme is administered by Department of Revenue.

- Refund of Duties and Taxes on Exported Products (RoDTEP) scheme has been introduced with an objective to neutralize the taxes and duties suffered on exported goods which are otherwise not credited or remitted or refunded in any manner and remain embedded in the export goods.

- Rebate of State & Central Taxes & Levies (RoSCTL) scheme is applicable for apparel/garments (under Chapter 61 and 62) and Made-ups (under Chapter 63). The Scheme is notified by The Ministry of Textiles and implemented by Department of Revenue with end to end digitization for issuance of transferable Duty Credit Scrip, which will be maintained in an electronic ledger in the Customs Systems (ICEGATE).