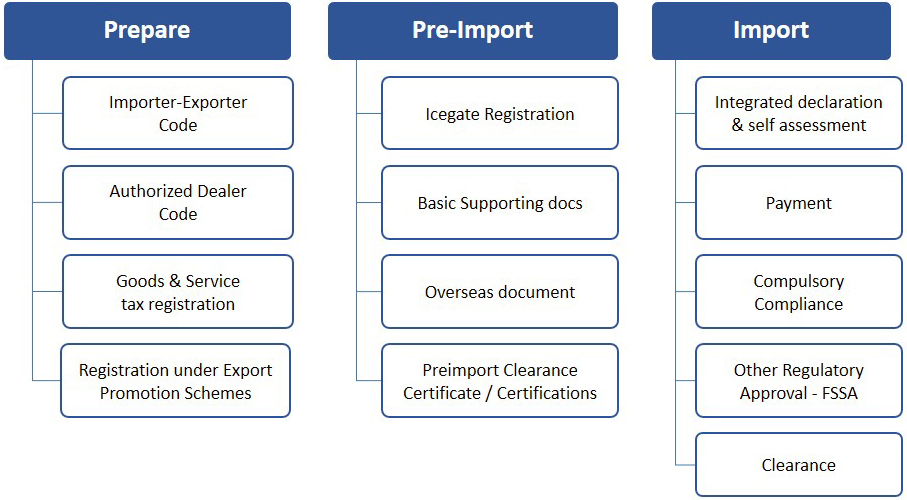

Importer-Exporter Code (IEC)

Prior to importing in India, every importer must first obtain an Importer-Exporter Code (IEC) number from the regional office of Directorate General of Foreign Trade (DGFT). The process to obtain the IEC number is Completely Online. Once an IEC is allotted, importer may import goods that are compliant with the provisions of Customs Act, 1962, Foreign Trade (Development & Regulation) Act, 1992 and the Foreign Trade Policy, 2020-25. However, certain items – restricted, canalized, or prohibited - as declared and notified by the government require additional permission and licenses from the DGFT and the central government.

Import licenses

Once an IEC is allotted, businesses may import goods that are compliant with Section 11 of the Customs Act (1962), Foreign Trade (Development & Regulation) Act (1992), and the Foreign Trade Policy, 2015-20. However, certain items – restricted, canalized, or prohibited, as declared and notified by the government – require additional permission and licenses from the DGFT and the central government.

For Example:

An import license may be either a general license or specific license. Under a general license, goods can be imported from any country, whereas a specific or individual license authorizes import only from specific countries. Import licenses are used in import clearance, are renewable, and typically valid for 24 months for capital goods or 12 months for raw materials components, consumables, and spare parts.

Filing of Bill of Entry (BE) and Customs clearance

For goods which are offloaded at airport for clearance, the importer, either himself or through his authorized Customs Broker (CB), is required to file a declaration in electronic format called as Bill of Entry using Indian Customs National Trade Portal https://www.icegate.gov.in/ or through the Service Centre located in the Air Cargo Complex, Sahar, Mumbai. Facility of uploading scanned documents along with the Bill of Entry is also available through ‘e Sanchit’ which is a state of art online repository for storing and handling supporting documents and is an essential component of paperless Customs clearance. Importers have the option to clear the goods for

- Home consumption after payment of duties leviable, or

- Warehousing without immediate discharge of the duties leviable in terms of the warehousing provisions of the Customs Act, 1962.

Import Commissionerate, Air Cargo Complex, Sahar, Mumbai handles the Customs clearances for such imported goods arriving at Air Cargo Complex except when goods are imported as Unaccompanied Baggage or through filing of Kachcha Bill of Entry. Imports through Unaccompanied Baggage or through Kachcha Bill of Entry are assessed and cleared by the General Commissionerate.

ATA Carnet

ATA Carnet is an International Uniform Customs document issued in 81 countries including India, which are parties to the Customs Convention on ATA Carnet. The ATA Carnet permits duty free temporary admission of goods into a member country without the need to raise customs bond, payment of duty and fulfilment of other customs formalities in one or a number of foreign countries.

ATA Carnets are guaranteed by FICCI (India's Sole National Issuing & Guaranteeing Association (NIGA) for ATA Carnet) and cleared at Air Cargo Complex, Sahar under two Notifications 157/1990 – Cus dated 28.03.1990 and 04/2018 dated 18.01.2018.

Notifications

-

157/90 dated 29.03.1990

(30.2 KB)

Under this notification, the goods described in Schedule I of the this notification, when imported into India for display or use at any event specified in Schedule II or Schedule III of the the notification, from the whole of the duty of customs leviable thereon which is specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) and from the whole of the additional duty leviable thereon under section 3 of the said Customs Tariff Act, subject to the conditions specified in the Notification 157/90 dated 29.03.1990.

-

04/2018 dated 18.01.2018

(33.2 KB)

Under this notification, the goods as specified in Schedule of this notification, when imported into India, from the whole of the duty of customs leviable thereon which is specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) and from the whole of the integrated tax leviable thereon under sub-section (7) of section 3 of the said Customs Tariff Act, subject to the conditions given in the notification.

- Reference website: https://www.atacarnet.in

Unaccompanied Baggage Centre (UBC)

The passengers can send their baggage through cargo which is treated as unaccompanied baggage. However, no free allowance is admissible in case of unaccompanied baggage which is chargeable to Customs duty @ 35% ad valorem + 3.5% social welfare surcharge(total 38.5% duty) and only used personal effects can be imported free of duty. The applicable conditions are:

- Provisions of Baggage Rules are also extended to unaccompanied baggage except where they have been specifically excluded.

- The unaccompanied baggage should be in the possession abroad of the passenger and shall be dispatched within one month of his arrival in India or within such further period as the Deputy/Assistant Commissioner of Customs may allow.

- The unaccompanied baggage may land in India up to two months before the arrival of the passenger or within such period, not exceeding one year as the Deputy/Assistant Commissioner of Customs may allow, for reasons to be recorded, if he is satisfied that the passenger was prevented from arriving in India within the period of two months due to circumstances beyond his control, such as sudden illness of the passenger or a member of his family, or natural calamities or disturbed conditions or disruption of the transport or travel arrangements in the country or countries concerned on any other reasons, which necessitated a change in the travel schedule of the passenger.

Bill of Entry - Cargo Declaration

Goods imported in a vessel/aircraft attract customs duty and unless these are not meant for customs clearance at the port/airport of arrival by particular vessel/aircraft and are intended for transit by the same vessel/aircraft or transhipment to another customs station or to any place outside India, detailed customs clearance formalities of the landed goods have to be followed by the importers. In regard to the transit goods, so long as these are mentioned in import report/IGM for transit to any place outside, Customs allows transit without payment of duty. Similarly for goods brought in by particular vessel/aircraft for transhipment to another customs station detailed customs clearance formalities at the port/airport of landing are not prescribed and simple transhipment procedure has to be followed by the carrier and the concerned agencies. The customs clearance formalities have to be complied with by the importer after arrival of the goods at the other customs station. There could also be cases of transhipment of the goods after unloading to a port outside India. Here also simpler procedure for transhipment has been prescribed by regulations, and no duty is required to be paid. (Sections 52 to 56 of the Customs are relevant in this regard)

For other goods which are offloaded importers have the option to clear the goods for home consumption after payment of the duties leviable or to clear them for warehousing without immediate discharge of the duties leviable in terms of the warehousing provisions built in the Customs Act. Every importer is required to file in terms of the Section 46 an entry (which is called Bill of entry) for home consumption or warehousing in the form, as prescribed by regulations.

Refer Circular No. 15/2009-Cus Dated 12/5/2009

If the goods are cleared through the EDI system no formal Bill of Entry is filed as it is generated in the computer system, but the importer is required to file a cargo declaration having prescribed particulars required for The Bill of entry, where filed, is to be submitted in a set, different copies meant for different purposes and also given different colour scheme, and on the body of the bill of entry the purpose for which it will be used is generally mentioned in the non-EDI declaration.

The importer clearing the goods for domestic consumption has to file bill of entry in four copies; original and duplicate are meant for customs, third copy for the importer and the fourth copy is meant for the bank for making remittances.

In the non-EDI system alongwith the bill of entry filed by the importer or his representative the following documents are also generally required:-

- Signed invoice

- Packing list

- Bill of Lading or Delivery Order/Airway Bill

- GATT declaration form duly filled in

- Importers/CHA’s declaration

- License wherever necessary

- Letter of Credit/Bank Draft/wherever necessary

- Insurance document

- Industrial License, if required

- Test report in case of chemicals

- Adhoc exemption order

- Catalogue, Technical write-up, Literature in case of machineries, spares, or

- Chemicals as may be applicable

- Separately split up value of spares, components, machineries

- Certificate of Origin, if preferential rate of duty is claimed

- No Commission declaration

While filing the bill of entry and giving various particulars as prescribed therein the correctness of the information given has also to be certified by the importer in the form a declaration at the foot of the bill of entry and any mis-declaration/incorrect declaration has legal consequences, and due precautions should be taken by importer while signing these declarations.

Under the EDI system, the importer does not submit documents as such for assessment but submits declarations in electronic format containing all the relevant information to the Service Centre. A signed paper copy of the declaration is taken by the service centre operator for non-repudiability of the declaration. A checklist is generated for verification of data by the importer/CHA. After verification, the data is submitted to the system by the Service Centre Operator and system then generates a B/E Number, which is endorsed on the printed checklist and returned to the importer/CHA. No original documents are taken at this stage. Original documents are taken at the time of examination. The importer/CHA also need to sign on the final document after Customs clearance.

The first stage for processing a bill of entry is what is termed the noting of the bill of entry, vis-à-vis, the IGM filed by the carrier. In the non-EDI system the importer has to get the bill of entry noted in the concerned unit which checks the consignment sought to be cleared having been manifested in the particular vessel and a bill of entry number is generated and indicated on all copies. After noting the bill of entry gets sent to the appraising section of the Custom House for assessment functions, payment of duty etc. In the EDI system, the Steamer Agents get the manifest filed through EDI or by using the service centre of the Custom House and the noting aspect is checked by the system itself – which also generates bill of entry number.

After noting/registration of the Bill of entry, it is forwarded manually or electronically to the concerned Appraising Group in the Custom House dealing with the commodity sought to be cleared. Appraising Wing of the Custom House has a number of Groups dealing with earmarked commodities falling under different Chapter Headings of the Customs Tariff and they take up further scrutiny for assessment, import permissibility etc. angle.

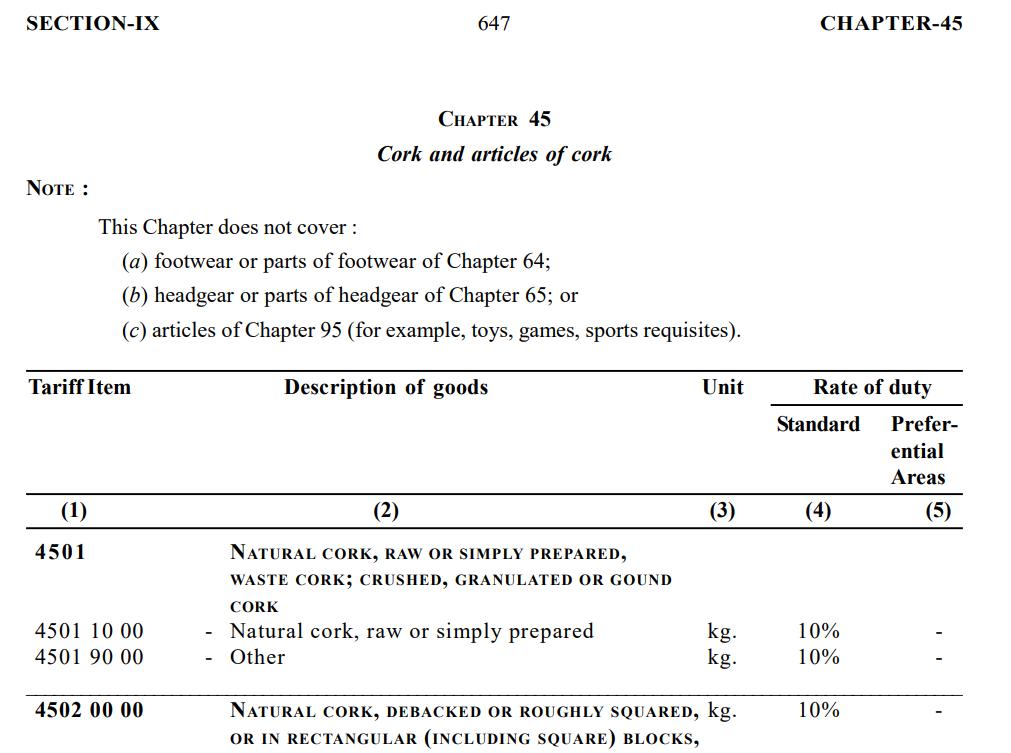

Assessment

The basic function of the assessing officer in the appraising groups is to determine the duty liability taking due note of any exemptions or benefits claimed under different export promotion schemes. They have also to check whether there are any restrictions or prohibitions on the goods imported and if they require any permission/license/permit etc., and if so whether these are forthcoming. Assessment of duty essentially involves proper classification of the goods imported in the customs tariff having due regard to the rules of interpretations, chapter and sections notes etc., and determining the duty liability. It also involves correct determination of value where the goods are assessable on ad valorem basis. The assessing officer has to take note of the invoice and other declarations submitted alongwith the bill of entry to support the valuation claim, and adjudge whether the transaction value method and the invoice value claimed for the basis of assessment is acceptable, or value needs to be redetermined having due regard to the provisions of Section 14 and the valuation rules issued thereunder, the case law and various instructions on the subject. He also takes note of the contemporaneous values and other information on valuation available with the Custom House.

Where the appraising officer is not very clear about the description of the goods from the document or as some doubts about the proper classification which may be possible only to determine after detailed examination of the nature of the goods or testing of its samples, he may give an examination order in advance of finalisation of assessment including order for drawing of representative sample. This is done generally on the reverse of the original copy of the bill of entry which is presented by the authorized agent of the importer to the appraising staff posted in the Docks/Air Cargo Complexes where the goods are got examined in the presence of the importer’s representative.

On receipt of the examination report the appraising officers in the group assesses the bill of entry. He indicates the final classification and valuation in the bill of entry indicating separately the various duties such as basic, countervailing, anti-dumping, safeguard duties etc., that may be leviable. Thereafter the bill of entry goes to Assistant Commissioner/Deputy Commissioner for confirmation depending upon certain value limits and sent to comptist who calculates the duty amount taking into account the rate of exchange at the relevant date as provided under Section 14 of the Customs Act.

After the assessment and calculation of the duty liability the importer’s representative has to deposit the duty calculated with the treasury or the nominated banks, whereafter he can go and seek delivery of the goods from the custodians.

Where the goods have already been examined for finalization of classification or valuation no further examination/checking by the dock appraising staff is required at the time of giving delivery and the goods can be taken delivery after taking appropriate orders and payment of dues to the custodians, if any.

In most cases, the appraising officer assessees the goods on the basis of information and details furnished to the importer in the bill of entry, invoice and other related documents including catalogue, write-up etc. He also determines whether the goods are permissible for import or there are any restriction/prohibition. He may allow payment of duty and delivery of the goods on what is called second check/appraising basis in case there are no restriction/prohibition. In this method, the duties as determined and calculated are paid in the Custom House and appropriate order is given on the reverse of the duplicate copy of the bill of entry and the importer or his agent after paying the duty submits the goods for examination in the import sheds in the docks etc., to the examining staff. If the goods are found to be as declared and no other discrepancies/mis-declarations etc., are detected, the importer or his agent can clear the goods after the shed appraiser gives out of charge order.

Wherever the importer is not satisfied with the classification, rate of duty or valuation as may be determined by the appraising officer, he can seek an assessment order. An appeal against the assessment order can be made to appropriate appellate authority within the time limits and in the manner prescribed.

EDI Assessment

In the EDI system of handling of the documents/declarations for taking import clearances as mentioned earlier the cargo declaration is transferred to the assessing officer in the groups electronically.

The assessing officer processes the cargo declaration on screen with regard to all the parameters as given above for manual process. However in EDI system, all the calculations are done by the system itself. In addition, the system also supplies useful information for calculation of duty, for example, when a particular exemption notification is accepted, the system itself gives the extent of exemption under that notification and calculates the duty accordingly. Similarly, it automatically applies relevant rate of exchange in force while calculating. Thus no comptist is required in EDI system. If assessing officer needs any clarification from the importer, he may raise a query. The query is printed at the service centre and the party replies to the query through the service centre.

After assessment, a copy of the assessed bill of entry is printed in the service centre. Under EDI, documents are normally examined at the time of examination of the goods. Final bill of entry is printed after ‘out of charge’ is given by the Custom Officer.

\In EDI system, in certain cases, the facility of system appraisal is available. Under this process, the declaration of importer is taken as correct and the system itself calculates duty which is paid by the importer. In such case, no assessing officer is involved.

Also, a facility of tele-enquiry is provided in certain major Customs stations through which the status of documents filed through EDI systems could be ascertained through the telephone. If nay query is raised, the same may be got printed through fax in the office of importer/exporter/CHA.

Examination of Goods

All imported goods are required to be examined for verification of correctness of description given in the bill of entry. However, a part of the consignment is selected on random selection basis and is examined. In case the importer does not have complete information with him at the time of import, he may request for examination of the goods before assessing the duty liability or, if the Customs Appraiser/Assistant Commissioner feels the goods are required to be examined before assessment, the goods are examined prior to assessment. This is called First Appraisement. The importer has to request for first check examination at the time of filing the bill of entry or at data entry stage. The reason for seeking First Appraisement is also required to be given. On original copy of the bill of entry, the Customs Appraiser records the examination order and returns the bill of entry to the importer/CHA with the direction for examination, who is to take it to the import shed for examination of the goods in the shed. Shed Appraiser/Dock examiner examines the goods as per examination order and records his findings. In case group has called for samples, he forwards sealed samples to the group. The importer is to bring back the said bill of entry to the assessing officer for assessing the duty. Appraiser assesses the bill of entry. It is countersigned by Assistant/Deputy Commissioner if the value is more than Rs. 1 lakh.

The goods can also be examined subsequent to assessment and payment of duty. This is called Second Appraisement. Most of the consignments are cleared on second appraisement basis. It is to be noted that whole of the consignment is not examined. Only those packages which are selected on random selection basis are examined in the shed.

Under the EDI system, the bill of entry, after assessment by the group or first appraisement, as the case may be, need to be presented at the counter for registration for examination in the import shed. A declaration for correctness of entries and genuineness of the original documents needs to be made at this stage. After registration, the B/E is passed on to the shed Appraiser for examination of the goods. Along-with the B/E, the CHA is to present all the necessary documents. After completing examination of the goods, the Shed Appraiser enters the report in System and transfers first appraisement B/E to the group and gives 'out of charge' in case of already assessed Bs/E. Thereupon, the system prints Bill of Entry and order of clearance (in triplicate). All these copies carry the examination report, order of clearance number and name of Shed Appraiser. The two copies each of B/E and the order are to be returned to the CHA/Importer, after the Appraiser signs them. One copy of the order is attached to the Customs copy of B/E and retained by the Shed Appraiser.

Green Channel facility

Execution of Bonds

Refer Circular No. 9/2007-Cus Dated 7/2/2007

Wherever necessary, for availing duty free assessment or concessional assessment under different schemes and notifications, execution of end use bonds with Bank Guarantee or other surety is required to be furnished. These have to be executed in prescribed forms before the assessing Appraiser.

Payment of Duty

The duty can be paid in the designated banks or through TR-6 challans. Different Custom Houses have authorised different banks for payment of duty. It is necessary to check the name of the bank and the branch before depositing the duty. Bank endorses the payment particulars in challan which is submitted to the Customs.

Amendment of Bill of Entry

Whenever mistakes are noticed after submission of documents, amendments to the of entry is carried out with the approval of Deputy/Assistant Commissioner. The request for amendment may be submitted with the supporting documents. For example, if the amendment of container number is required, a letter from shipping agent is required. Amendment in document may be permitted after the goods have been given out of charge i.e. goods have been cleared on sufficient proof being shown to the Deputy/Assistant Commissioner.

Prior Entry for Bill of Entry

For faster clearance of the goods, provision has been made in section 46 of the Act, to allow filing of bill of entry prior to arrival of goods. This bill of entry is valid if vessel/aircraft carrying the goods arrive within 30 days from the date of presentation of bill of entry.

The importer is to file 5 copies of the bill of entry and the fifth copy is called Advance Noting copy. The importer has to declare that the vessel/aircraft is due within 30 days and they have to present the bill of entry for final noting as soon as the IGM is filed. Advance noting is available to all imports except for into bond bill of entry and also during the special period.

Mother Vessel/Feeder vessel

Often in case of goods coming by container ships they are transferred at an intermediate ports (like Ceylon ) from mother vessel to smaller vessels called feeder vessels. At the time of filing of advance noting B/E, the importer does not know as to which vessel will finally bring the goods to Indian port. In such cases, the name of mother vessel may be filled in on the basis of the bill of lading. On arrival of the feeder vessel, the bill of entry may be amended to mention names of both mother vessel and feeder vessel.

Specialised Schemes

The import of goods are made under specialised schemes like DEEC or EOU etc. The importer in such cases is required to execute bonds with the Customs authorities for fulfilment of conditions of respective notifications. If the importer fails to fulfill the conditions, he has to pay the duty leviable on those goods. The amount of bond would be equal to the amount of duty leviable on the imported goods. The bank guarantee is also required alongwith the bond. However, the amount of bank guarantee depends upon the status of the importer like Super Star Trading House/Trading House etc.

Bill of Entry for Bond/Warehousing

A separate form of bill of entry is used for clearance of goods for warehousing. All documents as required to be attached with a Bill of Entry for home consumption are also required to be filed with bill of entry for warehousing. The bill of entry is assessed in the same manner and duty payable is determined. However, since duty is not required to be paid at the time of warehousing of the goods, the purpose of assessing the goods at this stage is to secure the duty in case the goods do not reach the warehouse. The duty is paid at the time of ex-bond clearance of goods for which an ex-bond bill of entry is filed. The rate of duty applicable to imported goods cleared from a warehouse is the rate in-force on the date on which the goods are actually removed from the warehouse.

(References: Bill of Entry (Forms) Regulations, 1976, ATA carnet (Form Bill of Entry and Shipping Bill) Regulations, 1990 ,Uncleared goods (Bill of entry) regulation, 1972, , CBEC Circulars No. 22/97, dated 4/7/1997, 63/97, dated 21/11/1997).

Export Procedures

Registration Process for Exporters

Exporters must obtain an Importer Exporter Code (IEC) from the Directorate General of Foreign Trade (DGFT) for filing a Shipping Bill. Exporters must also register their Authorised Foreign Exchange Dealer Code (AD Code) with Customs. Exporters intending to export under an Export Promotion Scheme must register their Licences/DEEC book with the Customs Authorities. Depending on the export policy, exporters may need specific licenses or permits from the Directorate General of Foreign Trade (DGFT) or other concerned authorities.

Processing of Shipping Bill

Shipping Bill is the primary document for customs clearance, detailing the goods, their value, and other relevant information. Under the EDI system, declarations must be filed through ICEGATE from the office of the Exporter or the Customs Broker. A checklist is generated for data verification by the exporter or their agent. After verification, the data is submitted to the system, which generates a Shipping Bill number. This number is endorsed on the printed checklist and returned to the exporter/agent. For exports subject to export cess, the TR-6 challan for cess is printed immediately after the Shipping Bill submission and must be paid at the designated bank.

Shipping bills are processed either automatically by the system based on the exporters' declarations or manually by Customs officers. If necessary, the officer may request for samples to verify declared values or classifications. Special instructions for examination may also be provided. After assessment (to determine the applicable duties and taxes) of the Shipping Bill an assessed copy of Shipping Bill is generated.

Exporters or their agents can check the status of the Shipping Bill at the Service Centre's query counter. The Shipping Bill is assessed once all queries are resolved.

Examination of Export Goods at Docks

Once the goods arrive at the port, the port authorities endorse the quantity of the goods received on the reverse of the checklist. Further, goods need to be brought to the designated area for registration & examination/inspection by the Customs authorities.

After registration of the Shipping Bill, the EDI System marks the Shipping Bill for inspection/examination. Customs officials will inspect/examine the goods to ensure they match the declared details based on the checklist and declarations submitted by the exporter and that all regulations are followed. If everything is as per declaration and as per policy/regulations, a "Let Export Order" is issued allowing the goods to be exported.

Whenever, there is a requirement of samples for analysis/testing of the goods, the Customs Officer draws samples and forward the same to the concerned testing lab.

Amendment in Shipping Bill

Any corrections in the checklist can be made at the Service Centre before the Shipping Bill number is generated. Once the Shipping Bill number is generated or when the goods have arrived at the Export Dock, amendments can only be made with the approval of the Assistant Commissioner (Export) or Additional/Joint Commissioner (Export). If changes are required after the issuance of the 'Let Export Order', the Shipping Bill must be amended and re-approved by the competent authorities.

Procedure for Post Clearance amendment in Shipping Bill: Exporter/CHA submits an amendment request along with supporting documents such as invoice, packing list, Bank Realization Certificate (BRC) etc.

The Manifest Clearance Department (MCD) Section verifies whether the request falls under permissible amendments as per Section 149 of the Customs Act, 1962. If documents are complete and amendments are valid, the file is forwarded to the Assistant/Deputy Commissioner for approval. Once approved, the manual certificate of amendment is issued to exporter as per the request of exporter. Amended details in the Shipping Bill are endorsed with an official remark to indicate post clearance modification.

Drawback

Duty Drawback is a scheme administered by CBIC to promote exports. It rebates the incidence of Customs and Central Excise duties, chargeable on imported and excisable material respectively when used as inputs for goods to be exported. This WTO compliant scheme ensures that exports are zero-rated and do not carry the burden of the specified taxes. The scheme comprises three categories, i.e.

- All Industry Rate (AIR) of Duty Drawback: The AIR of Duty Drawback for an export product is an average rate, based on the average quantity and value of material and average duties of Customs and Central Excise borne by each class of material, from which export goods are ordinarily manufactured.

- Brand Rate of Duty Drawback: Brand Rate of Duty Drawback is a unique facility provided to exporters for a rebate of actual duty incidence suffered by an export product. Under the Brand Rate mechanism, a specific Duty Drawback rate can be applied for by the exporter if the export product does not have an AIR or the available AIR neutralises less than 80 per cent of the duties paid on materials used in the manufacture of export goods.

Brand Rates are fixed by the local Commissioners of Customs having jurisdiction over the place of export of goods on which Brand rate of Duty Drawback is claimed

Pending the fixation of Brand Rate, the AIR of Duty Drawback, where available, can be availed upfront by the exporter.

Provisional Brand Rate can be allowed by the Commissioner of Customs on the exporter’s request.

Brand Rate of Duty Drawback is disbursed electronically directly to exporter’s account in a manner similar to the disbursal of AIR of Duty Drawback

- Duty Drawback on re-export of imported goods: Duty Drawback can also be claimed on the export of duty-paid imported goods. Under this facility, goods imported earlier may be exported and Duty Drawback of up to 98% of import duty paid can be claimed on such exports. Proof of duty paid on importation and identification of the export goods as those that were imported earlier are among the primary requirements under this scheme.

Procedures: Exporter files the Shipping Bill under Section 74 (Drawback allowable on Re-export of duty-paid goods) and brand rate Shipping Bill under section 75 (if drawback disbursed is low or not determined). The exporter files the application alongwith relevant documents to the Drawback Section to manually process the claim in both cases.

In the case of drawback application under Section 74, O-I-O is issued by the DC/AC, Drawback Section after following the due procedure and verifying the relevant documents. While in case of Brand Rate Shipping Bill, once the Brand rate fixed by the competent authority, the Shipping Bill processed in EDI System as a supplementary claim.

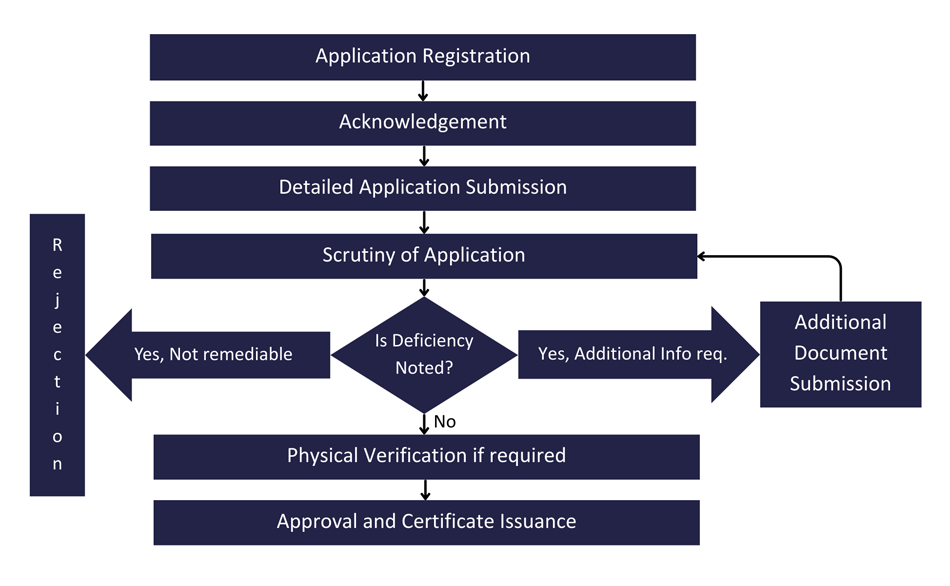

AEO Scheme (Authorised Economic Operator)

- AEO is a programme under the aegis of the World Customs Organization (WCO) SAFE Framework of Standards to secure and facilitate Global Trade. The programme aims to enhance international supply chain security and facilitate movement of legitimate goods.AEO encompasses various players in the International supply chain.

- Under this programme, an entity engaged in international trade is approved by Customs as compliant with supply chain security standards and granted AEO status & certain benefits.

- India’s AEO Programme is in sync with the commitments made under Article 7.7 of WTO TFA. AEO is a voluntary compliance programme. It enables Indian Customs to enhance and streamline cargo security through close cooperation with the principle stakeholders of the international supply chain viz. importers, exporters, logistics providers, custodians or terminal operators, custom brokers and warehouse operators.

Application Process:

AEO Cell, Mumbai Zone – III Initiatives

- Annual AEO Mela

- “Wednesday is AEO Day” Initiative

- Webinar on AEO Certification and its Benefits

- AEO Interactive Session in India Russia Business Meet

- AEO Interactive Session in various business meets

OMS (Obligation Management System)

OMS is an online portal “Obligation Management System (OMS)” (https://oms.accmumbai.gov.in/) using Block Chain technology for registration/cancellation and monitoring of Advance Authorizations (AA).

All the Advance Authorizations are registered/cancelled in a faceless manner, where Trade uploads the document from his office on OMS and if any query(s) is raised by the department, that is also replied on OMS itself in online mode. Moreover, the Notices for submission of Export Obligation Discharge Certificate (EODC) are automatically and timely sent by the OMS, thereby improving the compliance of discharge of export obligation.

Export Promotion Schemes

- Advance Authorisation Scheme (AA) allows duty free import of inputs, which are physically incorporated in export product (making normal allowance for wastage). Fuel, oil, catalyst which is consumed / utilized in the process of production of export product, may also be allowed.

- Duty Exemption Entitlement Certificate (DEEC) scheme manages duty-free import of inputs under the Duty-Free Exemption Certificate (DEEC) Scheme for exporters.

- Duty Free Import Authorisation (DFIA) similar to the Advance Authorisation Scheme (AA), it allows duty free import of inputs but on Post Export basis only.

- Export Promotion Capital Goods (EPCG) scheme allows import of Capital Goods for producing quality goods and services to enhance India’s export. The EPCG Scheme allows Import of Capital Goods at Zero Customs Duty. Integrated Goods and Service Tax (IGST) and compensation Cess are also exempted under the scheme.

- Duty Drawback (DBK) allows rebate of duty on any goods manufactured in India and Exported. DBK excludes Integrated Goods and Service Tax (IGST) and Compensation. The Duty Drawback Scheme is administered by Department of Revenue.

- Refund of Duties and Taxes on Exported Products (RoDTEP) scheme has been introduced with an objective to neutralize the taxes and duties suffered on exported goods which are otherwise not credited or remitted or refunded in any manner and remain embedded in the export goods.

- Rebate of State & Central Taxes & Levies (RoSCTL) scheme is applicable for apparel/garments (under Chapter 61 and 62) and Made-ups (under Chapter 63). The Scheme is notified by The Ministry of Textiles and implemented by Department of Revenue with end to end digitization for issuance of transferable Duty Credit Scrip, which will be maintained in an electronic ledger in the Customs Systems (ICEGATE).