Import Commissionerate

- Helpline No. : 022-26828947

- Email: import[dot]acc[at]gov[dot]in

Trade Facilitation And Grievance Redressal

Indian Customs Compliance Information Portal

The Central Board for Indirect Taxes and Customs (CBIC) launched the Indian Customs Compliance Information Portal (CIP) in 2021 at https://foservices.icegate.gov.in/cip/ to provide free access to information on all Customs procedures and regulatory compliance for nearly 12,000 Customs Tariff Items. The CIP is a facilitation tool that provides up-to-date information on the legal and procedural requirements regarding Customs and other regulatory government agencies (FSSAI, AQIS, PQIS, Drug Controller etc.).

Turant Suvidha Kendra (TSK)

TSK provides a single-point interface for importers and Customs Brokers to facilitate the following functions:

- The document verification by Customs officers at Assessment and Customs Compliance Verification (CCV) stages are normally based on the documents uploaded in the e-Sanchit and does not require physical submission of documents. However, if in any exceptional situation the physical submission of documents is required by Customs, for defacement or validation, such submission is made only at the TSKs

- Accept Bond or Bank Guarantee.

- Carry out any other verification that may be referred by Faceless Assessment Groups.

- Defacing of documents/ permits licenses, wherever required.

[Refer : Circular No. 28/2020-Cus. dtd. 25.06.2020, 45/2020-Cus. dtd. 12.10.2020,

Instruction No. 09/2020 dtd. 05.06.2020, Public Notice No. 54/2025 dtd. 15.10.2025]

022-26816696

tsk[dott]accmumbaizone3[at]gov[dot]in

Grievance Redressal Related To Cargo Clearance

- Public Grievance Officer (PGO): Import Commissionerate, Air Cargo Complex, Sahar, Mumbai has a designated PGO who may be approached by the trade and public if their grievance are not being redressed by the dealing officer or his supervising officer.

- Permanent Trade Facilitation Committee (PTFC): PTFC having membership of all stakeholders functions in the Air Cargo Complex, Sahar, Mumbai to resolve local issues.

- PTFC meetings are organized by the Import Commissionerate and are held regularly with minimum of one meeting per month on a pre-decided date.

- Apex trade bodies are allowed to attend the PTFC meetings along with their local constituents, who are members of the PTFC.

- Efforts are made to regularly review the membership of the PTFC with the aim of including all stakeholders in the Customs functioning.

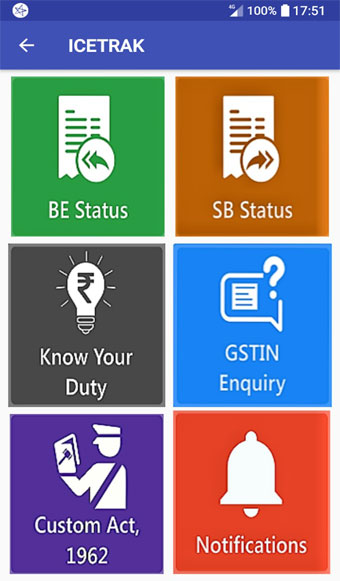

Indian Customs Enquiry for Trade Assistance and Knowledge (ICETRAK)

The free mobile app, ICETRAK, enables stakeholders to live track the BE/SB status, duty calculator, GSTN enquiry and validate the gate pass/BE/SB copies with QR code scanning functionality. QR Scanning facility in ICETRAK assures authenticity of Electronic documents to any public by making use of encryption and digital signature technologies.