Import Commissionerate

- Helpline No. : 022-26828947

- Email: import[dot]acc[at]gov[dot]in

Clearance of Imported Goods

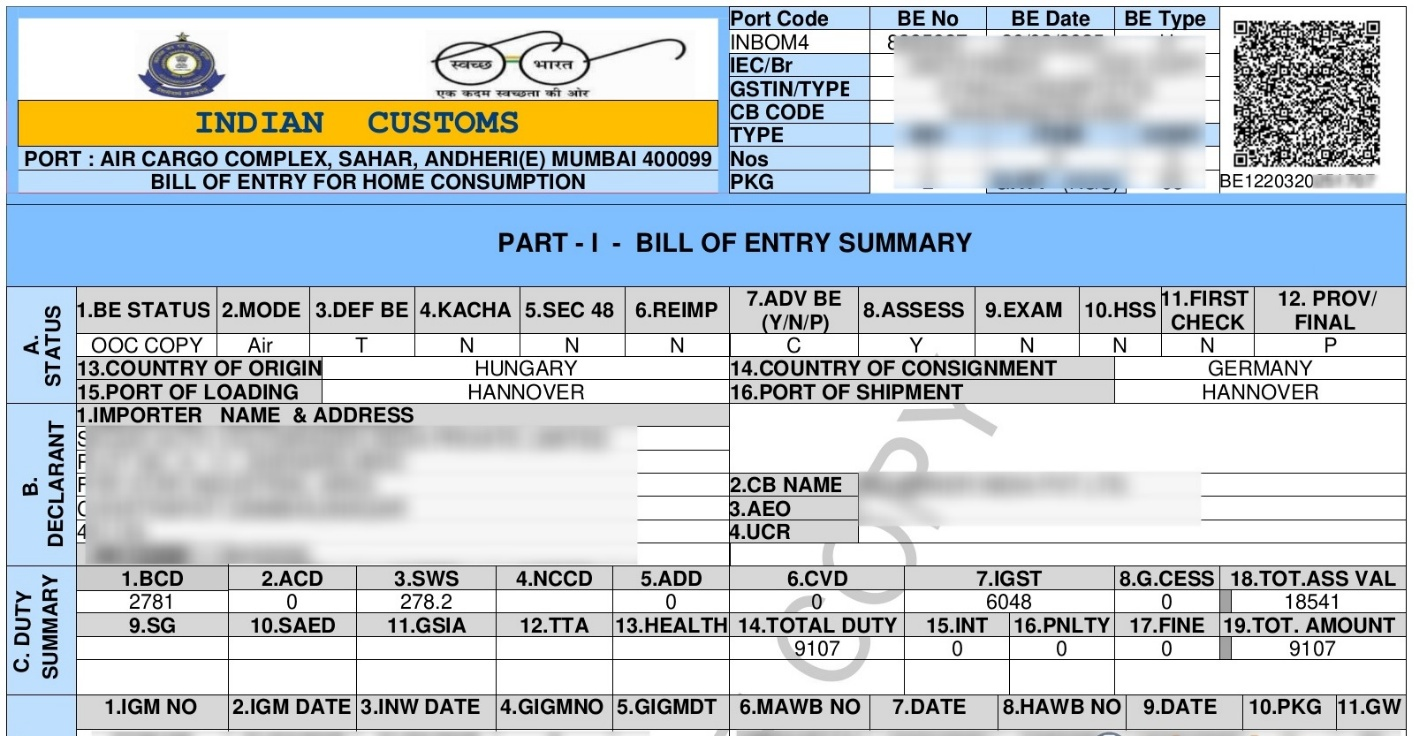

Bill of Entry (BE)

For goods which are offloaded at airport for clearance, the importer, either himself or through his authorized Customs Broker (CB), is required to file a declaration in electronic format called as Bill of Entry using ICEGATE Portal or through the Service Centre located in the Air Cargo Complex, Sahar, Mumbai. Facility of uploading scanned documents along with the Bill of Entry is also available through ‘e Sanchit’ which is a state of art online repository for storing and handling supporting documents and is an essential component of paperless Customs clearance. Importers have the option to clear the goods for

- Home consumption after payment of duties leviable, or

- Warehousing without immediate discharge of the duties leviable in terms of the warehousing provisions of the Customs Act, 1962.

Foreign Trade Policy provides that Importer-Exporter Code (IEC) number, a 10-character alpha-numeric allotted to a person by the Directorate General of Foreign Trade (DGFT) is mandatory for undertaking any export/import activities. However, the following categories of importers or exporters are exempted from obtaining IEC.

| Sr. No. | Categories Exempted from obtaining IEC |

|---|---|

| 1 | Importers covered by clause 3(1) [except sub- clauses (e) and (I)] and exporters covered by clause 3(2) [except sub-clauses (i) and (k)] of Foreign Trade (Exemption from application of Rules in certain cases) Order, 1993. |

| 2 | Ministries/Departments of Central or State Government |

| 3 | Persons importing or exporting goods for personal use not connected with trade or manufacture or agriculture. |

| 4 | Persons importing/exporting goods from/to Nepal; Bhutan; Myanmar (through Indo-Myanmar border areas); and China (through Gunji, Namgaya Shipkila and Nathula ports), provided that the CIF value of single consignment of import/export of goods from/to Nepal; Bhutan and Myanmar (through Indo-Myanmar border areas) does not exceed Indian Rs. 25,000/-; and in the case of China, (a) for import/export of goods through Gunji and Namgaya Shipkila, CIF value of single consignment does not exceed Indian Rs.1,00,000/-; and (b) for import/export of goods through Nathula, CIF value of single consignment does not exceed Rs.2,00,000/-. |

Further, the following permanent IEC numbers are required to be used by non–commercial PSUs and categories or importers/exporters mentioned against them for import/export purposes.

| Sr. No. | Permanent IEC | Categories of Importer / Exporter |

|---|---|---|

| 1 | AMDCG0111E | All Ministries / Departments of Central Government and agencies wholly or partially owned by them. |

| 2 | ADSGA0129E | All Departments of any State Government and agencies wholly or partially owned by them. |

| 3 | DCUNO0137E | Diplomatic personnel, Counsellor officers in India and officials of UNO and its specialised agencies. |

| 4 | IABBR0145E | Indians returning from / going abroad and claiming benefit under Baggage Rules. |

| 5 | IIHIE0153E | Persons /Institutions /Hospitals importing or exporting goods for personal use, not connected with trade or manufacture or agriculture. |

| 6 | IIEGN0161E | Persons importing/exporting goods from/to Nepal for non-commercial purposes |

| 7 | IIEGM0170E | Persons importing / exporting goods from / to Myanmar through Indo-Myanmar border areas for non-commercial purposes |

| 8 | ATAEF1096E | Importers importing goods for display or use in fairs/ exhibitions or similar events under provisions of ATA carnet. This IEC number can also be used by importers importing for exhibitions/fairs as per Paragraph 2.60 of Handbook of Procedures |

| 9 | IDNBG1100E | Director, National Blood Group |

| 10 | ICIRN1126E | Individuals /Charitable Institution/Registered NGOs importing goods, which have been exempted from Customs duty under Notification issued by Ministry of Finance for bonafide use by victims affected by natural calamity. |

| 11 | IIEGC1134E | Persons importing/exporting permissible goods as notified from time to time, from/to China through Gunji, Namgaya Shipkila and Nathula ports, subject to value ceilings of single consignment as given in Paragraph 2.07 (iv) above. |

| 12 | NCIEE1169E | Non-commercial imports and exports by entities who have been authorised by Reserve Bank of India. |

Prior Entry for Bill of Entry

For faster clearance of the goods, filing of Bill of Entry prior to arrival of goods is mandated. This Bill of Entry is valid if aircraft carrying the goods arrives within 30 days from the date of presentation of Bill of Entry.

The Bill of Entry is required to be filed before the end of next day following the day (excluding holidays) on which the aircraft carrying the goods arrives at a Customs station at which such goods are to be cleared for home consumption or warehousing.

Wherein the Bill of Entry is not filed within specified time and the proper officer of customs is satisfied that there is no sufficient cause for such delay, the importer shall be liable to pay charges for the late presentation of Bill of Entry at the rate of rupees five thousand per day for initial three days of the default and at the rate of rupees ten thousand per day for each day of default thereafter.

Self-Assessment of Imported Goods

The imported goods before clearance for home consumption or for warehousing are required to comply with prescribed Customs clearance formalities. This includes presentation of a Bill of Entry containing details such as description of goods, value, quantity, exemption notification, Customs Tariff Heading etc. The Bill of Entry is subject to verification by the proper officer of Customs (under self-assessment scheme) and may be reassessed if declarations are found to be incorrect.

Under self-assessment, it is the importer who will ensure that he declares the correct classification, applicable rate of duty, value, benefit of exemption notifications claimed, if any, etc. in respect of the imported goods while presenting Bill of Entry.

Normally import declarations made are scrutinized with reference to documents and other information about the value / classification etc., without prior examination of goods. It is at the time of clearance of goods that these are examined by the Customs to confirm the nature of goods, valuation and other aspects of the declarations. However, it may be noted that examination of goods is carried out only after facilitation level is decided by the Risk Management System (RMS). In case no discrepancies are observed at the time of examination of goods 'Out of Charge' order is issued and thereafter the goods can be cleared.

In cases, where the importer is not able to determine the duty liability or make self-assessment for any reason, except in cases where examination is requested by the importer, a request shall be made to the Customs officer for provisional assessment of duty. In such a situation an option is available to the Customs officer to resort to provisional assessment of duty by asking the importer to furnish security as deemed fit for payment of the deficiency, if any, between the duty as may be finally assessed or re-assessed, as the case may be, and the duty provisionally assessed.

Faceless Assessment

Faceless Assessment, a component of the Turant Customs Programme, is an initiative aimed at introducing anonymity and uniformity in Customs assessments pan India. Faceless Assessment uses a technology platform to separate the Customs assessment process from the physical location of a Customs officer at the port of arrival. This measure is with the intent of bolstering efforts to ensure an objective, free, fair and just assessment. Key objectives of Faceless Assessment include

- Anonymity in assessment for reduced physical interface between trade and Customs

- Speedier Customs clearances through efficient utilization of manpower

- Greater uniformity of assessment across locations

- Promoting sector specific and functional specialization in assessment

To further smoothen implementation of Faceless Assessment and to have a robust system in place for meeting desired objectives as above, the Central Board of Indirect Taxes and Customs (CBIC) has constituted National Assessment Centres (NACs). These NACs have been mandated, amongst other responsibilities, to monitor assessments, to set up structures for liaising with different Customs formations and Directorates under CBIC, to function as knowledge hub for the commodities assigned to that particular NAC.

Import Commissionerate, Air Cargo Complex, Sahar, Mumbai [Port code: INBOM4] is part of the following NACs

NAC Chemicals [Convenor: Pr. Chief Commissioner/Chief Commissioner, Mumbai Customs Zone II]

- Faceless Asessment Group 2 (Chapter 28) – Products of Chemical or Allied Industries - I

- Faceless Asessment Group 2B (Chapters 30-31) – Products of Chemical or Allied Industries - III

- Faceless Asessment Group 2C (Chapters 32-34) – Products of Chemical or Allied Industries - IV

- Faceless Asessment Group 2D (Chapters 35-36) – Products of Chemical or Allied Industries - V

- Faceless Asessment Group 2F (Chapter 38) – Products of Chemical or Allied Industries - VII

- Faceless Asessment Group 2K (Chapters 47-49) – Products made of Wood

NAC Mechanical Machineries [Convenor: Pr. Chief Commissioner/Chief Commissioner, Mumbai Customs Zone III]

- Faceless Asessment Group 5 (Chapter 84: 8401 - 8469) – Machinery & Mechanical Appliances - I

- Faceless Asessment Group 5E (Chapter 84: 8470 - 8473) – Machinery & Mechanical Appliances - II

- Faceless Asessment Group 5N (Chapter 84: 8474 - 8487) – Machinery & Mechanical Appliances - III

NAC Electric Machineries [Convenor: Pr. Chief Commissioner/Chief Commissioner, Chennai Customs Zone]

- Faceless Asessment Group 5A (Chapter 85: 8501 - 8516) – Electrical machinery

- Faceless Asessment Group 5C (Chapter 85: 8517 - 8531) – Communication and related equipment

- Faceless Asessment Group 5M (Chapter 85: 8532 - 8548) – Micro-electronics

NAC Automobile and Instruments & Miscellaneous Products [Convenor: Pr. Chief Commissioner/Chief Commissioner, Mumbai Customs Zone I]

- Faceless Asessment Group 5F (Chapter 88) – Aircrafts

- Faceless Asessment Group 5I (Chapter 90-92) – Instruments & Apparatus

- Faceless Asessment Group 6 (Chapter 93-98) – Miscellaneous Products/Project Imports

SVC (Special Valuation Cell)

Special Valuation Cell (SVC) of the Import Comissionerate, Air Cargo Complex, Sahar, Mumbai is mandated with the finalization of the provisionally assessed Bills of Entry subsequent to the receipt of the Invetstigation Report (IR) from the ‘Special Valuation Branch’ (SVB). SVB is an institution specializing in investigation of transactions involving special relationships and certain special features having bearing on value of import goods. SVBs are located only at five Custom Houses, i.e., Chennai, Kolkata, Delhi, Bangalore and Mumbai and any decision taken in respect of a particular case in any of these Custom Houses is followed by all other Custom Houses/formations.

The Special Valuation Branch of that Custom House, which is located proximate to the Head or Corporate Office of the importer (having special relationships etc. with the suppliers), handles the investigation into valuation of such importer.

Payment of Duty

Electronic Cash Ledger (ECL) facility has been provided to the users to create a virtual account on ICEGATE website that acts as a mode of payment to pay Customs duty online apart from the current modes of payment which are Internet Banking and NEFT/RTGS.

Further, the facility to generate a self-initiated challan for voluntary payments and then make payments through the ICEGATE e-payment platform without any further approval by officers of Customs has also been made operational at the Air Cargo Complex, Sahar, Mumbai.

Execution of Bonds

For availing partial or complete exemption from duties under different schemes and notifications, execution of End Use/Provisional Duty bonds with Bank Guarantee or other surety may be required in the prescribed forms. The amount of bond and bank guarantee is determined in terms of the instructions issued by the Central Board of Indirect Taxes and Customs (CBIC) or conditions of the relevant notification or provisions of the Customs Act, 1962 or rules/regulations made there under.

Turant Suvidha Kendra (TSK) in Import Commissionerate has been made a single-point interface for importers and Customs Brokers for execution/defacement/verification of the Bonds and Bank Guarantees.

Web based registration of goods

An importer/Customs Broker can self-initiate the process of electronic registration of goods, examination, documentary verification and issuance of Out Of Charge (OOC) on the ICEGATE Portal. This initiative has dispensed the need for importer physically present hard copy of BE along with the supporting documents at a facilitation centre for registration.

Examination of Goods

The imported goods, which are interdicted for examination by the Risk Management System, are required to be examined for verification of correctness of description/declaration given in the Bill of Entry and related documents. The imported goods may also be examined prior to assessment (called as “First Check”) in cases where the importer does not have complete information with him at the time of import and requests for examination of the goods before assessing the duty liability or, where the proper officer, on reasonable belief feels that the goods should be examined before assessment, giving reasons for the same. Wherever required, samples are drawn in the examination area for chemical analysis, verification or any other purposes.

After assessment by the appraising group or for cases where examination is carried out before assessment, Bill of Entry needs to be presented for registration for examination of imported goods in the Import Shed. The proper officer of Customs examines the goods along with requisite documents. The shipments, found in order are given clearance order by the Customs officer in the Import Shed.

Auto Queuing

Post registration, the goods are presented by the importer/Customs Broker for examination and subsequently queued before the OOC officer on a First-in First-Out (FIFO) basis. The Bills of Entry which are fully facilitated by the Risk Management System are automatically routed to the Customs officer for giving clearance after registration has been completed by the importer. Automated Out of Charge has also been implemented by Air Cargo Complex, Sahar, Mumbai for Authorized Economic Operators Tier 2 and Tier 3 Provided the following conditions are met

- The BE is not selected for examination or scanning or for any Partner Government Agency (PGA) related NOC.

- Assessment of the BE is complete.

- Duty payment is completed/ Authentication of BE by way of OTP is complete for duty deferment.

Customs Compliance Verification (CCV) (Auto Clearance)

The introduction of a CCV has delinked duty payment and allows the importer to self register the imported goods and paves the way for the Customs officer to conclude necessary compliance verifications and conditionally clear the BE in the system. The importer may thereafter make the duty payment, receive OOC electronically and proceed to take the goods out of Customs control.

E-OOC Bill of Entry

A secure QR code enabled PDF based final copy of BE is electronically dispatched to the Customs Brokers/importers in the email address registered on ICEGATE. This electronic communication reduces the interface between the Customs authorities and the importers/Customs Brokers and also do away with the requirement of taking bulky printouts from the Service Centre or maintenance of voluminous physical dockets in the Air Cargo Complex.

e-Gatepass

An e-Gatepass is shared with Custodians, Mumbai International Airport Limited (MIAL) and AI Airport Services Limited (AIASL), via electronic messaging. This ensures the Custodians have advance information to prepare for identification and making available the goods for delivery to importer. The e-Gatepass helps in faster movement of goods out of the port of import.

Amendment of Bill of Entry

Bonafide mistakes noticed after submission of documents, may be rectified by way of amendment to the Bill of Entry with the approval of Deputy/Assistant Commissioner of Customs, in-charge of the respective Port Assessment Group (PAG).

Request for amendments under Section 149 of the Customs Act, 1962 leading to reassessments: Amendments under Section 149 of Customs Act, 1962 and consequent reassessment are based on the request of the importers to change the elements of assessment. For instance, request for amendment by an importer claiming that he has forgotten to claim an exemption or is in possession of some document that requires an element such as freight etc. to be changed.